Bittensor: Machine Learning Decentralized

Marketplace for Machine Intelligence

ChatGPT and its subsequent iterations ushered in an incredible year of AI. Every startup sought to pivot to AI

while tech giants like Google scrambled to find their foothold in the space. But amidst these centralized corporations fighting for a share of the pie, one project has been quietly pioneering its own paradigm - decentralized intelligence - which could change how AI is developed and accessed forever.

Enter Bittensor.

What is Bittensor?

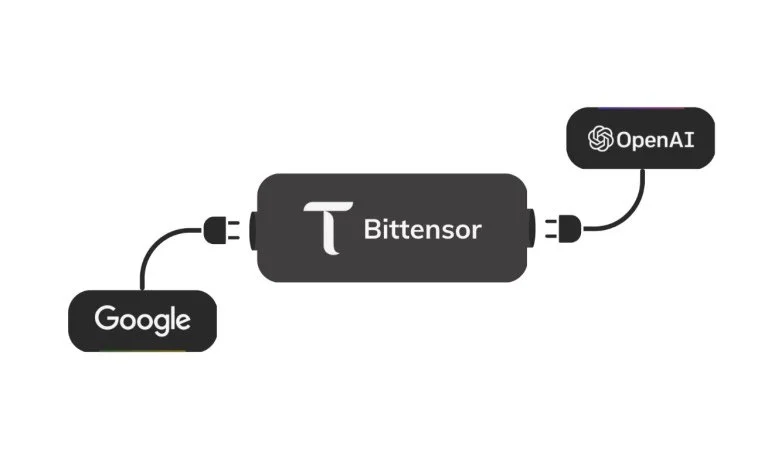

Bittensor seeks to decentralize access to AI and the development of machine learning models, which have long been accessible only to large, centralized corporations such as OpenAI and Google, which had the resources to pour into training these models.

Such training often cost these companies millions in funding, which was well out of reach for most smaller companies, much less individuals. Bittensor is designed as the marketplace for machine intelligence, using a peer-to-peer network to value the intelligence stored on the network as well as reward honest contributors to the network.

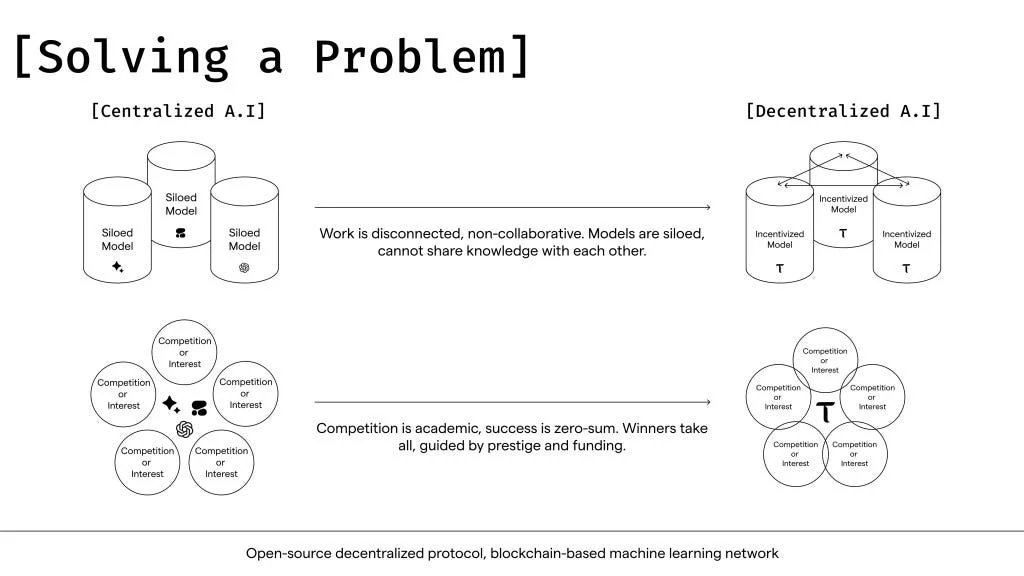

Beyond just increasing the accessibility of machine learning capabilities, Bittensor was designed to tear down the walls of siloed systems that corporations built to protect their machine learning models. By opening up the models built through Bittensor, Bittensor would enable composability and compounding of AI development, further pushing the space forward.

The Bittensor Network

To achieve its goals of censorship-resistant access to machine learning models, the Bittensor team originally built the network as a parachain, Finney, on the Polkadot network. This decision was later reversed, and Bittensor later migrated to its own chain to reduce reliance on the Polkadot ecosystem. Bittensor launched its own Proof-of-Work chain in March 2023, which was designed after the original cryptocurrency, Bitcoin.

Bitcoin brought computers together to validate which validators had the most computing power through Proof-of-Work and thus were entitled to the largest rewards. In essence, Bitcoin created an efficient market for computing power. Similarly, Bittensor treats data as a commodity, and the network seeks to create a marketplace for machine intelligence where intelligence is valued and scored in a peer-to-peer manner. These scores are recorded on a digital ledger, where peers are rewarded based on the rank awarded, thereby granting them more weight in the network.

Thwarting Collusion on Bittensor

However, in its simplest form, this system faces the threat of collusion, which could easily undermine the network’s accuracy. By simple collusion, peers in the network could rank each other highly through dishonest voting. Bittensor takes a two-pronged approach to target this threat - through incentives and bonds.

Expanding on the basic ranking model, Bittensor introduces an incentive component to reduce the risk of collusion. The network limits the rewards available to peers who have not reached a consensus. Consensus, in this case, refers to the peer having achieved a non-zero ranking from more than 50% of the stake in the network. This means that assuming the malicious actors do not already hold a majority stake in the network, they would have to gain votes from the honest majority in order to increase the rewards they are earning to gain a greater share of the network.

While the incentive component above protects the network from simple collusion, it does not incentivize honest ranking of peers in the network. Bittensor encourages this via bonds, which can be considered a speculative element in the ranking system. In simple terms, a peer accumulates bonds with peers that they rank, in a sense ‘bonding’ them to these peers. If these peers do well due to their contributions to the network, their bonded peers also benefit from greater rewards. As such, the bonding mechanism encourages peers to accumulate bonds with peers that they expect to be perceived well by other peers in the network, thus speculating on their future value. Therefore, this aligns peer ranking within the network and incentivizes honest ranking of peers.

Subnetworks

The Bittensor network is split into a handful of smaller networks known as subnetworks. Each of these subnetworks can be thought of as a self-contained economic market to incentivize access to different forms of machine intelligence, such as text generation, image generation, data scraping, machine translation, and more. Each subnetwork is set up and run by an owner, who will also determine the incentive structure of the subnetwork. Every subnetwork will consist of 3 types of users: miners, validators, and end users.

Miners, sometimes known as servers, are off-chain machine learning nodes that service requests on the network for data from the network users. The work submitted by these miners is evaluated and valued, after which they are rewarded in Bittensor’s native token, TAO, as a reward for their contribution. Miners who repeatedly submit inferior work will eventually be disincentivized to participate and drop out of the subnetwork.

Validators validate the work done by miners to ensure that the work is accurate and up to the standards of the subnetwork. While subnetworks can provide a validation template for validators to use, validators can also write their own validation mechanisms to express their preferences on what the network should learn. Not only does this encourage miners to continuously improve their output, but it also increases diversity in the network and reduces the risk of any shareholder dictating what the network should be learning.

Finally, end users are the customers of the Bittensor network. They make requests via the Bittensor API, BitAPAI, which is then passed to the miners to be fulfilled. These subnetworks are designed to be easily accessible via common programming languages such as Python, Node.js, Golang, Rust, and more. At the moment, BitAPAI is free to use to encourage the development of the network, although each key is limited for now to prevent abuse.

Projects Built on Bittensor

Although Bittensor is still very much in its infancy, several projects have already sprung up to tap into the value of the network.

A popular type of project building on the network is ChatGPT-style AI systems, where users enter a text input and receive a reply from the system. Some of the projects in this space include Chattensor, ChatNI, Chat with Hal and BitAPAI Chat.

ReplyTensor is another popular Bittensor project, which leverages the text and image generation subnets to generate replies based on users’ prompts. Currently, the service is supported on Twitter, Telegram and Discord. ReplyTensor is developed by Neural Internet; an AI-focused research and development DAO who has also been one of the most active builders on Bittensor.

The TAO Token

The Bittensor network, much like Bitcoin, is powered by a single token, TAO. Designed to promote censorship resistance and fairness, the tokenomics of TAO follows Bitcoin’s design closely as well, with no presale or private token deals. Even the founding team had to mine for their own TAO tokens.

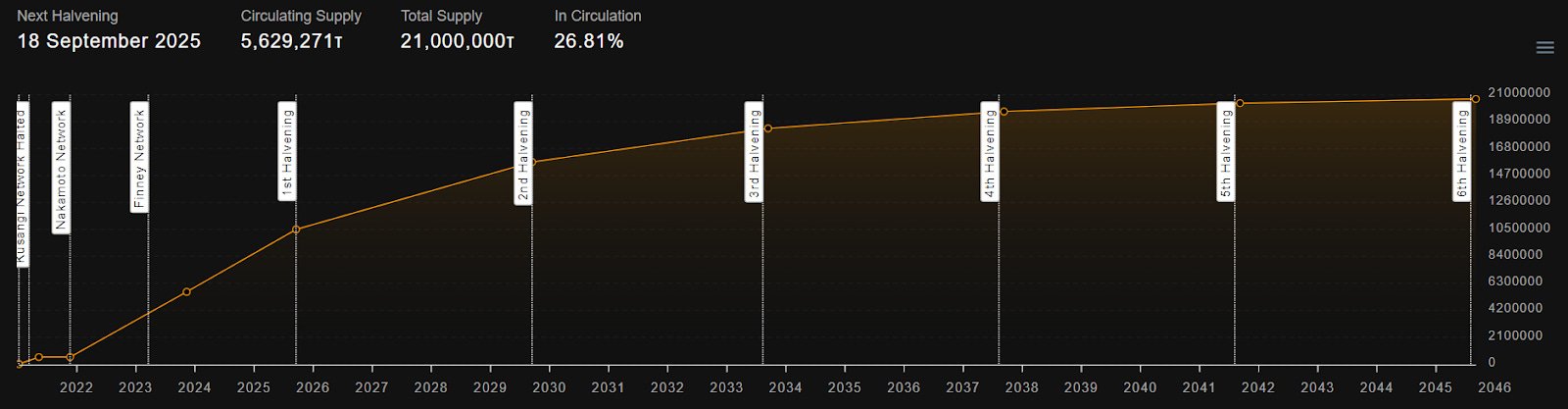

TAO also follows Bitcoin’s supply and release schedule, with a maximum supply of 21 million tokens and a halvening process every 10.5 million blocks, which cuts the TAO inflation rate by half every time. The first halvening event is expected to occur in September 2025, with a total of 64 halving events.

Conclusion

The siloed approach and high cost of training hold back the development of machine learning models and suppress innovation in the space. As AI continues to evolve and increasingly revolutionize the way we work, Bittensor will become an increasingly powerful force in the AI space.

Leveraging its decentralized approach to the training of machine learning models and the composability it provides, Bittensor’s goal is to eventually become the marketplace for machine intelligence, where individuals, smaller companies and even corporations pay in TAO to connect to the Bittensor network and utilize its resources.