The rise of store-of-value alternatives - the market for fiat debasement solutions

As BTC became institutional, new POW chains and privacy coins are receiving more attention as new forms of store-of-value assets.

https://x.com/kelxyz_/status/1897354675466461304

What started the crypto industry is Bitcoin. bitcoin created a few things in the same time . all of this things are not with us anymore : i believe we are witnessing a return of store of value/gold/btc alternatives in the form of useful pow and privacy coins .

first, what was bitcoin?

a game of computer coordination ( pow ) - this is a very important attribute that didnt got enough attention over the years outside of bitcoin

Cypher Punk Idiology: rebel against absolute power ( nowdays its open ai , back then it was tradfi )

The rise of useful pow and AI money

We are at a point similar to 2009 ( when BTC was invented ) -

Inflation is destroying everyone's buying power

ai labs are threatening to take over all power.

projects with a potential to become ai money

duplex - enabling data centers to train and mine at the same time

boundless ($zkc)

nockchain - zk proof mining

privacy coins and chains :

zcash 4b 50b ( store of value , established )

aleo 518m private payments

nym 47m private payments

namada 18m shilding exising chains

neptune cash low , 250 fdv l1 stark with a smart cotract

ironfish 26m 3b ( privacy coin backed by the best )

OG pow coins that didn't shine yet:

litecoin LTC 7BN$ 10% silver ( 300bn)

kaspa 1.6bn

new frontiers oct : cypher punk monies , stable infras , decentralized health

things that im looking at right now :

btc alternatives : the point is , btc used to be many things and now its non of this things - a cypher punk form of money , store of value etc. now its just an institutional asset . so what will take this gap imo is

privacy coins and programmable privacy: coins - zcash (4b , could be 50) . aleo private payments(671mn$ ), nym - private payment and vpn (50mn$), namada (18mn$)

Privacy is finally interesting because its the first time in history that it will be accepeted by the admin.

useful pow ( ai and zk ): nockchain - zk proof mining , ambient (ai specific work ) , duplex - ai generalized work

2. decentralized health - a stack of new approaches like

gene theraphy and peptides

light theraphy

reduction in poisons in shampoo , sunscreen , plastic , psychodelics instead of alcohol , no seed oils

money games

Expanding speculation on the internet.

Money games: tools for fixing capital and the right way to understand crypto assets :

The purpose of crypto is to fix capital, creating a better capital systems that flow value to people who create this value. And not let corruption extract value from this system.

There is a lens that not many people see when thinking about tokens. The type of question everyone is asking is what they should be evaluated by: revenues/utility etc.

But my view is that money games, ie, the mechanism behind each token, is more telling than the topic behind the token.

Money games are systems that want to replace corrupt and rigged financial systems with more equitable systems. These money games serve as a coordination tool for people to unite around changing this financial system and creating an alternative system where value flows as it should ( to the people that create it ).

The way to evaluate money games is not based on revenues / DCF but based on what they are replacing, combined with parameters that are related to the mechanism of participation :

Gold was a rigged system and BTC created a mechanism pow to mine digitally. That created a better form of gold. So Btc is better evaluated in a way that uses that system. And its comp.

The finance and loan system is rigged - banks get to print and delute our money and most people don't get this loans in they Ste unfortunate. DeFi and the pool system created a P2p financial system and they should be evaluated based on that system (tvl / fees ) as well as the comp they are creating.

Art is rigged - NFTs and the mint system created a better way to trade and own art on the internet.

AI is centralized and closed -decentralized training let everyone participate and value should be measured based on the intelligence value they create.

Science funding is corrupt and rigged - desci is making efforts to replace (so far without a proper mechanism so it didnt took off yet )

Higher education is rigged - ??

recent new money games :

pokemon lootboxes - https://courtyard.io , tcgcenter.app

useful pow l1s : zkc , nock , duplex , ambient

Remember the goal: the goal is to fix capitalism and wealth distribution so it will serve most people. Like capitalism should be.

Future things to fix :

our institutions :

Gov-owned entities and offices - transparency and operations

Research and new knowledge

News

also called it flat orgs

In the last 12 years in crypto, we created many money games, building blocks we can use to replace these systems.

long.xyz ultimate goal is to create the infrastructure for the rebellious. People who want to replace the rigged system can use money games to do so. Very much like Satoshi created POW to fix gold.

The power of money games to facilitate coordination:

tl;dr : my main point in this doc is that the powerful force is not revenues, but it is a consensus around how value is created and the way the asset is evaluated. In this doc I'll talk about the evolution of money games in crypto and where we are going from here.

-Speculation & coordination is the source of all good, because it's creating coordination, and coordination is a force that people used to achieve big things. when coordination and speculation came together historically they created most of the progress - from the 2000 tech bubble, the Manhattan Project and the Apollo program. doesnt matter if the coordination is the cause of a new way to measure a financial asset ( reflexive matrics like tvl etc) or it is a top down goal like the apollo program , the result is a new era of progress .

Money games are about the way the capital asset is issued and the way we are evaluating it.

The main money game in finance (pre-crypto) - value investing theory / dcf- this was populated by Ben Graham and Warren Buffett and extended to evaluating tech companies. The idea that revenues are the sole metric we should use to evaluate any kind of endeavor.

These metric was very valuable pre-internet, became less valuable with tech cos, and with crypto protocols became even less relevant as a sole framework.

players :

professional investors - align on the “value theory” populated by Ben Graham. The best entrepreneurs are the ones who understand how to game this game and emphasize TAM and

Definition of money games: What I'm going to focus on in this doc is specifically a token-related money games & issuance mechanisms ( money games 2.0)

the core of money games are an evaluation metric ( coins are stocks revenues/utility value / memetic value etc ) as well as a comp value (ico will replace ipo , nfts will replace art ) . in the trad world, new money games created their metrics and their dreams (dotcom bubble / manhattan project / apollo program ) .

The history of money games:

Pre-Internet - value investing and rev metrics enable investors to fuel business, games like art fueled creators using the tax benefits investors get from it

Money games 1.0 - The internet created more scalable business but the metric didnt change much; people still used multiples to evaluate .

Enter Money Games 2.0 :

programmable money games - the rules are more complicated - with crypto, we came up with a different way to issue, and so came up with new analogies, like comparison to commodities, vouchers and many other things. But I'll show that these money games mainly create a new coordination around how value is created and evaluated so the analogy for what they represent is secondary .

Crypto is beyond just a better way to issue stocks; it is a focal point for people to coordinate around and achieve their goals. The primary goals of replacing an existing system.

As investors, we should have a few models of evaluation for each asset class, not only based on its content (team /industry ) but also on the type of money game.

the history of money games 2.0 :

pre 2017: proof of work

Proof of stake - Proof-of-Stake (PoS) was first conceived in 2011 and implemented in 2012 with the launch of Peercoin, which was the first cryptocurrency to utilize a PoS-like system.

2017 ICO Boom: 2017 ICOs: investors sent eth in exchange for project tokens, raising an estimated $20 billion over two years. Tech Enabler: Ethereum’s ERC-20 token standard, which allowed anyone to easily create and distribute tokens on-chain.

2018 Play-to-earn breeding/battling: Breed Axies (NFTs) for battles; earn SLP/AXS tokens redeemable off-chain.

2018 - fomo 3d -A timer-based lottery Ponzi. Players buy "keys" with ETH (starting at 0.1 ETH each, increasing over time). Each purchase adds 30 seconds to a 24-hour countdown timer. When the timer hits zero, the last buyer wins ~48% of the pot; the rest is distributed as dividends to key holders (10% to Team JUST, 10% to a sequel game, etc.).

2020 DeFi Farming Season - Tech Enabler: Automated Market Makers (AMMs) (like Uniswap, launched in 2018, but gaining traction in 2020). COMP yield farming showed users they could earn tokens for using a protocol, creating the farming meta.

2021 NFT Boom: Tech Enabler: ERC-721 standard for unique digital assets + Ethereum scaling (L2s, sidechains like Polygon). Marketplaces and Platforms: The boom spurred the development of numerous NFT marketplaces and platforms, facilitating the creation, sale, and trading of NFTs.- Trading volumes reached $57.2 billion

2022- airdrops farming - Farming involved speculative interactions to qualify for unannounced ("retroactive") airdrops, often via multi-wallet strategies. However, this led to widespread Sybil attacks, where individuals created fake identities to multiply rewards

2024 Memecoin Season: Solana’s low fees + the launch of memecoins like WIF & BONK going viral. Solana recovered from 2022’s crash, Memecoins became community-driven cultural movements.

2022 tipping coins - like degen chain AND kaito - rewarding app user and becoming a proxy of that app

2025 yield sale (ao computer ) using the yield as a sale for tokens

2025 Doppler and long - modular compostable auction based liquidity bootstrapping

2025 - Twitter launch (believe )

2025 -$gor - using a memecoin launch as a fair distribution for real crypto businesses .

The future of money games 2.0 :

Crypto as a terrain for new games - using crypto primitives to create another MMO game

New Frontiers for money games 2.0 (crypto version ) :

new mechanisms

prediction markets

reward with inflation (tao )

interconnected markets - zora and virtuals

new segments -

AI training funding mechanism

RWA x gamified mechanism -

ar vr and metaverse revival

social app x crypto - Soulbound tokens proving useful (on-chain resumes, credit scores).

ways to bet on social media, games around chat gpt usage

On-Chain Social & Identity

New token standards :

ERC-6551 (Token-Bound Accounts): AI agents can own assets and interact with protocols.

Soulbound Tokens (SBTs): For reputation/trust in AI-generated content.

ERC-3643 (Permissioned Tokens): Institutional-grade AI projects needing regulatory compliance.

ERC-6551 allows NFT items to own other assets

ERC-6551 (Token-Bound Accounts): NFTs as wallets, enabling dynamic in-game assets.

ERC-721C (Creator Fees Standard): Ensures royalties in gaming NFT marketplaces. ERC-1155 (Multi-Asset Tokens): Efficient for gaming items (single contract holds multiple asset types).

Infrastructure for games is the biggest business

Within crypto -

l1s - like Solana and eth

dexs and nft markets - like pump fun

defi protocols

outside of crypto :

AI creation tool for games

Stablecoin infra for payment

So, you probably ask: what am I doing to push through this future ?

money games 2.0 grant program

Creating a monthly competition, giving away 200k$ every month to 2 game developers who build money games 2.0 or infrastructure for them.

Target cracked founders aged 18-21

Build a brand like AllianceDAO, but center it specifically on money games

Ideal candidate: already a talent curator crypto, has a lot of energy, needs to be deeply crypto native (ideally class of 2021 or prev), and down for a gig, lives in NYC, in-person organizer

Let's get crypto back to its true origin, reconnect to our rebellious nature, and not try to be someone else.

Unbundling the state: what talents should work on

How to industrialize government-owned Subsidiaries and research areas

aigrant.com for x

context :

The world's largest companies have transformed government entities and research areas into entirely new industries. They've expanded human knowledge and created profitable sectors that weren't previously considered industries. These innovations emerged from government-subsidized projects or academic research fields. For example:

SpaceX created the space industry where only gov entities used to compete (NASA)

Neuralink created the bci industry where only research labs used to do this work

OpenAI created the AI industry where neural networks used to be a field in math

The boring company innovate on public infrastructure - where only municipalities used to operate

Tesla created electric cars - something that was not considered possible 10 years ago.

There are a lot of topics today that are important for humanity, but there is not much knowledge about so only government entities and universities are working on , creating mini funds to encourage startups to work on them can create new knowledge and trillions$ of new value in the world .

Things that are going to be fields ( ai grant play )

digital/new countries

Consciousness & telepathy

ecosystem map

https://docs.google.com/document/d/1Eh5UMZXPCpBKH_jH57L9EPkxl8ZceOmvDbFt2lwV-u0/edit?pli=1&tab=t.0

digital areology

plastic detection and reduction

government transparency

organizing short squeez - like gamestop at scale

memecoins that want to transend institutions

bio electricity

understanding of the natural world (ocean / animals etc )

AI is very good at understanding patterns but we are lacking data from the natural world

neo markets and money games

Dark Matter and Dark Energy

Impact of Artificial Intelligence on Society

The Psychology of Conspiracy Theories:

The Global Freshwater Cycle:

The Microbiome Beyond Gut Health:

Peptides, hormones, compounding drugs (current, hot)

post progressive capitalism and its opportunities

capitalistic mindset to solve social issues

capitalistic mindset to solve social issues

Big picture :

Dollar devaluation and rising Inflation, & the stagnation of salaries

Late capitalism and hyper addictive industries: social media, food, pharma, gambling, pornography. Lead to spiritual decay and over-sexualization

Post AI institutional decay: universities, finance, health system, no new things anymore in the arts ( movies/ sond / architecture etc)

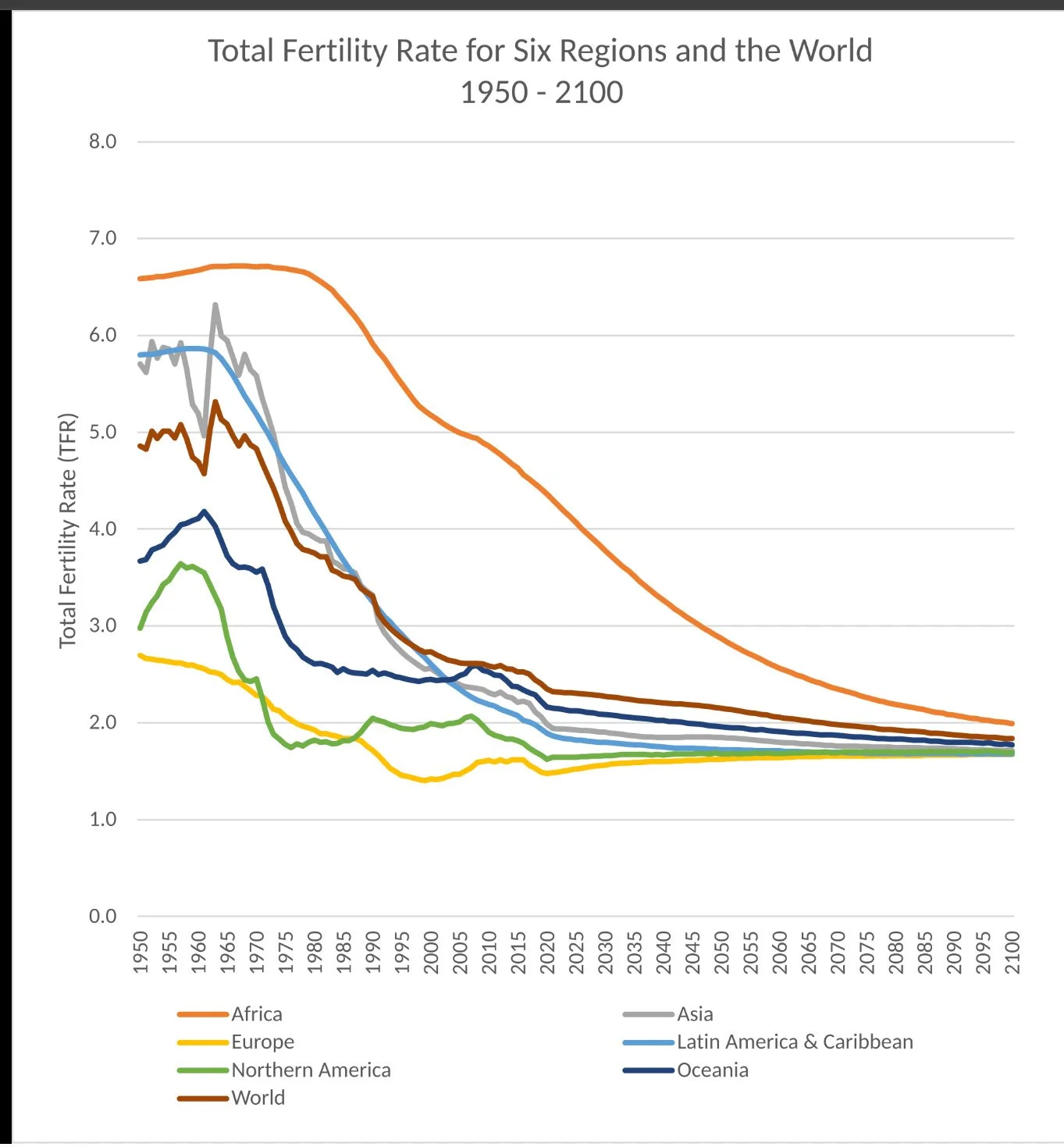

The need for family: Family formation and global fertility decline rapidly - need for a substitute for the family

The future: Rebelion/ socialist capitalism – a new type of capitalism that involved building new institutions, communally owned

What people are searching for :

Seek assets that can outperform inflation

sick groups that provide connection, meaning, belonging, adventure

—

Second-order effects :

Rise of socialism - asset confiscation, muslim liberal rise(1,2,3) , rise in hate crime

Rising demand for information markets: aliens , wokism , epstein etc

Rising demand for assets to overcome inflation

—------

The opportunities for builders: replacing all institutions

The center of the thesis is that the future of capitalism will serve all the people that are not served by it right now , one class are the workers and the other class are the “non capitalistic “ builders - artists , communities , researchers etc. so - i recon that all institutions that are dysfunctional will be replaced by a better , completely new type of institutions .

Always ask:

Is the institution that exists giving you the SHORTCUT (paper, badge, diploma, income) it promises.

If it slows you down, then it needs to either be reformed or replaced.

Dollar devaluation broke capitalism

Downstream of a dollar devaluation is the entire economy. Basic research is not getting funded anymore; artists and communities are not participating in capitalism.

Fund the unfundable - the birth of capitalistic socialism

expect markets to replace a lot of society's pillars, same as polymarket replaces news

New knowledge, new frontiers that are not industries yet ( things like neural networks before it was AI :

Consciousness

Long-term Effects of Microplastics on Human Health

Dark Matter and Dark Energy:

Impact of Artificial Intelligence on Society

The Psychology of Conspiracy Theories:

The Global Freshwater Cycle:

The Microbiome Beyond Gut Health:

Peptides, hormones, compounding drugs (current, hot)

2. Open source versions of things that are usually not a startups - ( deep tech and things like food, housing and archaeology

3. Activism reimagined - movement: art ,communities to solve societal issues

Activism/communities/art projects like( like yimby or plasticlist )

Financial rebellion assets :

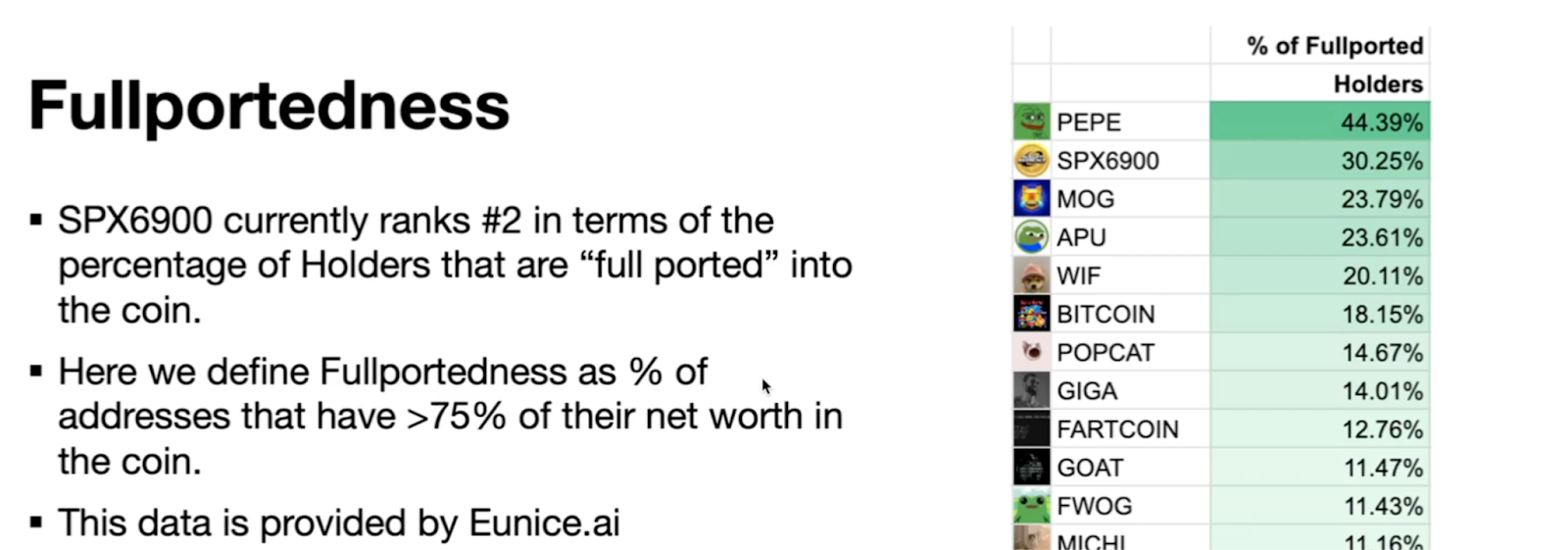

Spx6900

the next trillion$ assets will be built by a rebel

Pure belief assets are a new asset class to solve society's issues and the founders of this assets will be rebels

Over the next 10 years, all social institutions are expected to undergo significant changes, with new versions emerging. One of them is pure belief assets . ( 1,2,3 )

Bitcoin is the original PBA - we just didn't have a name for it at the time It was first "unconscious" and now it is "conscious." SPX is the first conscious PBA from the outset

GameStop exhibited a new type of emerging behavior, where a group of people with a strong belief can bring it into existence if they have financial assets at the center. Like an ant swarm

The age that we are in

Capitalist institutions is up for grabs, we are in a transition moment. where all the institutions of society are being recreated, this is a time where legends will be made . new type charities universities , google ,social media, yc , new financial institutions, the family institutions , roles of the governments like defence and much more .

But who will create this future ?

The future institutions will be built by rebellion founders .

rebellion founders and ideas are ones that proposed an alternative to culture , politics, fight corruption or just have unpopular ideas.

Why is rejected ideas/ founders are so important to fund?

In a world where capitalism doesn't work for most people, the mainstream institutions' elites trying to maintain the status quo, and these rejected ideas are rejected for a reason; they are trying to change the status quo.

What is the opportunity here?

Rebellious individuals solve the most pressing needs of society - the inability to win in the current game.

The biggest untapped opportunity that everyone is ignoring right now is the struggles of the young generation: fighting corruption , beating inflation , spiritual alternative loneliness and above all- a vehicle for rebelion .

Not only does capitalism not work for everyone, Agi eliminates jobs and identity in an era where jobs are the main source of identity, which will make the crisis worse

.

The communities that will dominate the future will be communities with a rebellious goal :

Rejected science

Consciousness communities / Psychedelics/ astrology

https://www.costarastrology.com/

Financialize rebellious communities

$gme

Surface hidden secrets /conspiracy/ reveal corruption

Drive culture and political change

Againt ivf and pro natural procreation

Other types of cyber punks on the internet

What's common to all of these founders and communities around them is that they do not fitting into society and find connection with each other . and by doing so find meaning community and wealth. this is the future of belief on the internet.

2. Enter pure belief assets: rebelion + a financial asset create alchemy :

Because most of the things we are talking about are not VC-backed, new institutions religions, ideologies , societal strucutre - can't be a company. They must use a different structure to fund themselves.

Gamestop showed humanity a clue for what's possible, when a group of people with a specific tangible goal have a financial asset in the center ( could be a stock or a coin ) they are united and are able to achieve big things. These type of organizations aren't companies and work completely differently; it also evaluated differently.

3. Ideas for community-coordinated tokens :

Treasure hunt token - a token that will give away all the fees to people who expose information on aliens or achieve a certain tech advancement in Consciousness research.

A prediction token - a token that rewards holders when a certain tech advancement will happen earlier rather than later - open open-source AI model will beat a closed-source AI model

Summary :

All the institutions that society is based on are being recreated, trillion-dollar institutions will be created in the process

The transition will not be nice so the rebellious founders will be the one who build it

The new versions will look weird and probably not vc backable , spx and gamestop are good references

Cypher punks and rebelions will rebuild society , so dont fade them .

The Digital spirituality asset class

how an internet native religions may looks like

What is Spx : PBA: Pure Belief Assets/internet native religion / mmor / tokenized spirituality

We are witnessing a new asset class: neo religions, aka tokenized spirituality.

What if you could own a piece of Christianity?

A merger between a financial asset, a belief system, an inclusive community that serves as a substitute for family, and most importantly, a divine mission. This creates an absolute alchemy. Akin to a spiritual focal point that people can unite around, and by doing so, help transform everyone's lives.

Disclaimer - this is challenging to understand because it's a relatively new concept in the world.

The thesis is :

The next religion will not be like the previous religions.

The next religion will be have be an asset

The next religion will be financialized, rebellious, internet culture, and tokenized. (akin to ripple , GameStop)

Spx is the first case of tokenized religion.

—-

Why do we need new religions? The old religions no longer help solve the struggles of society.

The Societal Issues and the need for neo-religions :

The need to survive: The middle class is having a harder and harder time

2. The need for family: Family formation and global fertility decline rapidly - need for a substitute for the family

3. Loneliness and the need for friendships are skyrocketing -traditional religions are no longer a solution for Gen Z

4. AI and late capitalism make this trend worse:

Late capitalism devolves into addiction engineering: social media, food, pharma, gambling, pornography. Lead to spiritual decay and over-sexualization

Agi eliminates jobs and identity in an era where jobs are the main source of identity

Conclusions: 1. More expensive worlds 2. More competitive 3. Income and wealth inequality continue 4. Nihilism is on the rise 5. Ai coming for their jobs and identity. ——-lead people to seek assets that can outperform inflation, stocks and Btc 2. Make people sick groups that provide connection, meaning, belonging, adventure

At the same time, what is happening with crypto: 1. Corporations buy Btc 2. Stablecoin adoption grows rapidly and will become mainstream. Understanding that tokens are about people, mimetic and virallity then about tech or utility.

—-----------------------------------

Entering neo religions, tokenized spirituality.

You probably saw stuff like XRP or GameStop, but you couldn't classify or explain it from first principles Pov so you classified it as a joke, right? I was also in that mindset, but I think I'm starting to realize what is happening here. Here is what I think the future of spirituality looks like :

Genz is angry and lives on the internet, the next religion will be internet-based and one that speaks to the young gen and helps them solve their problems: own assets, loneliness & family, culture, and value alignment

Hence, the next neo religion will be an asset that enables millions of people to coalesce around and let them a medium to channel their anger and energies and express their views, in the same time find people who share the same views and achieve this bigger than life mission and while doing that, massively improve their life and solve their needs for friends, family and wealth.

Digital spirituality asset class: The market participants overlook this extremely valuable aspect - the market for things that can satisfy people's spiritual and psychological needs is in the trillions. highest levels of spirituality - the cognisphere is the spiritual consciousness.

The reason for the emergence of tokenized belief: found a way to make something intangible tangible - a vessel to channel the collective trust and belief of the community into a financial asset, community behavior gets imitated and it's a black hole for people looking for something meaningful

Spx - the first neo-religion :

Components of SPX that make it a good candidate to become the next internet version of Christianity :

Goal: Flip the Stock Market- The only meme coin with a goal: 1. The goal is to flip the stock market. The only coin with an actual mission - tangible measurable misssion - act to unite, strengthen and inspire the community, giving it a clear direction.

Anonymous founder

Token Values: Love, Hope & Belief

Clear identity: more than 10k dedicated "AEONs" : They are the name people give to those holding SPX token, it means eternity in ancient Latin

face videos: willing to dox- an important piece is that most strong communities have a lot of doxed people as well as deep philosophical work , similar to btc in the early days .

Cultural innovation: Represent Shift in priorities - stop trading and believe in something, shift in how we interact with financial markets, convergence of technology, culture and community - new era where value of the collective can drive economic value. As its continues to challenge financial systems, it's flipping the notion of value itself.

10 commandments :

touching points

The asset of the Younger generation : they own nothing, no money , no political power, no clout Good at social media. Spx is a Social cultural financial vessels represent a mimetic counter reaction of the younger generations.

Pressure valve theory of finance assets - people feel the need to get behind an asset- a vessel of dissatisfaction - akin to GME and the like

most BTC-like asset: 1. Inherent cipher punk, holding, dca, believing, and evangelizing 2. Unhinged delusion - best possible situation from A mental perspective 3. People diallision by the lack of prospects in their lives - express the need for an alternative asst to invest in - one that defies the norms tof raditional financial

SPX did to GME, what btc did to gold : GME had a way to make corruption .

Paradigm shift: represents the next frontier of the growth of internet culture. economics of belief. Collective belief is the only fundamental that matters in economics. Trad stock market is undergoing a significant evolution

Signs the asset is near a critical mass :

Creators in the community: amount and depth of philosophical content by the community

Number of “maximalists “: people who devote their all lives to spx

More than 10k people actively identify as aeons

3. Loyalty of holders - parabolic moves (doge/shiba)are caused by supply squeeze, as a result of most holders don't plan to sell

The TAM of spirituality :

The tam is north 100T, and the only examples we currently have are bitcoin, gold, and Tesl,etc :

The next frontier of spirituality will come as financial assets that create leverage of spiritual loyalty.

Spirituality creates extreme stickiness, which in case of a financial asset creates a supply crunch . the supply crunch is crucial at the point of critical mass - funds and institutional investors joining create a Cambrian explosion, examples :

Doge : dec29-may6 of 2021: 150x in 5 month

Xrp : Nov 24-Jun 20 of 2025 - 30x from 33b to 180b in 2 month

Shiba ino

Summary

Religions are failing to meet the existential and communal needs they once addressed.

Fertility decline, widespread loneliness, and the inability to keep up with inflation are worsening across society.

There is a new asset class: neo-religions will be a financial asset with an internet community that serves as a spiritual focal point that people can unite around, and by doing so, help transform everyone's lives.

Spx is the first neo-religion reaching critical mass.

The conservative valuation for it is xrp , and GameStop, but can also look at it as holding a piece of Christianity, which would be a multi-trillion-dollar asset .

shades of attention tokens:

ways meme coins can expand

ways meme coins can expand

Meme coins have made everyone realize that tokens are primarily about attention. However, meme coins today are still too simplistic. What second-generation meme coins will look like:

the meme stack: we now understand that everything is a meme: a mechanism (PoW/L2), a segment (social, cross-chain/DePIN), and even values (privacy). Different people’s attention is drawn to different memes.

There are two types of investors: long-term ones who care about fundamentals and get in early, and retail investors who come in late based on signals.

The interesting gap is between the long-term effort (VC-backed projects) and the short-term traders.

Attention arbitrages are key for 2nd-generation meme coins.

As I wrote here, sometimes attention arbitrages arise—cases where people want to invest in something, but the asset is not investable. Monad and Berachain are current examples of this for retail investors.

This is one of the most important concepts for understanding 2nd-gen meme coins.

Some examples from the recent past:

Friends Tech: Enabled investing in people (bonding curve mechanism).

*Degen.tips*: Invest in forecasters (airdrop).

Constitution DAO: Investing in an important artifact (IDO).

Types of arbitrages and mechanisms for 2nd-gen memes:

Private market - to Meme: The peak attention for most VC projects is just before launch. During this period, there’s a lot of attention around the token, but no asset to invest in. Meme coins that serve as proxies for projects that haven’t launched yet will do very well.

Charity and Lawsuits: I also wrote about it here. Tokens can fund a class action lawsuit or a charitable cause. Lock 50% of the token and release it when it reaches X value. $Not a Security is an example.

Real-World Tipping Using zk-TLS: Meme coins could be awarded to people who prove certain real-world actions, such as sperm donation or purchasing shoes. More from Dan Elitzer. This is interesting because it creates a proxy for investing in a topic outside direct reach—a new category.

Acquisition Memes: Similar to the second point and Constitution DAO.

tech and freedom summary(by jack dorsey)

permissionless tech will become more meaningful in the future

permissionless tech will become more meaningful in the future

permission, and the things you need to ask for in your life.

money

speech

intelligence

money - to participate in this economy you need permission. from the government, the bank - to participate.

Speech - permission to speak on social media, and normal media. even to speak peer to peer , the platforms need to give permission. These accounts can be shut down

by intelligence - in the future, intelligence will be in the hands of open ai , need to ask permission to access to intelligence, a solution is good hardware and a good models.

who do you need to ask permission from :

the government - your ownership is just a lease from the government

corporation - have profit incentive, you are not the customer

yourself - cancel culture, and be judged by society is the permission you are asking for . you'll not do certain things because you afraid,

btc genesis: connection between governments and corporations

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

why it is important to seek permissionless tech :

empower activism - to act and not be surveillance ;

empower science - breakthroughs are not happening because it's treatment corporation. need to build a permission environment

art - permissioned art stopping from things to be successful

how to do permissionless tech

money - btc - something that is permissionless payments

communication - nostr - running servers , each server hold all content, own your data .

intelligence - private cloud, open source models

what to do :

map the services you use in money and speech and map how you interact with them , what you give, and what you get

the next generation will be about solving meaning and loneliness

the biggest problem of our generation is loneliness and loss of meaning.

we need to bring back friendship to the internet.

first, why is this happening?

on egalitarian individuals, intersectional theory of identity, and emergent publics

our past and our desired future: before modernity - individuals were born into families rooted within kin-based institutions that provided everything: livelihood , substance, and meaning.

the beginning of the problem: this institution was eroded by roman empire in what created individualism (everyone is equal).

on that basis, Max Weber authored the theory of the modern state which helped the creation of modern states we know today.

intersectional theory of identity: in 1908 George Simmel pioneered the idea of intersectional identity, claiming that individuals identities are deeply formed through their social relations : humans gain crucial aspects of their sense of self , goals and meaning through participation in social groups. people define themselves based on their community .

John Dewey and the emergent publics: if individuals are so fluid and dynamic , surely so too must be the social circles that intersect to constitute it : new social groups constantly forming .

the critical pathway to creating such new circles was the establishment of places where new groups can come to know one another and understand things they don't have in common with others in the broader society. These shared secrets allowed for a common interest

technology creating new publics: which share different social problems .

Distribution and Mimetic Value Creation

Mimetic Value Creation - How to Distribute and Create Mimetic Value - Part 1

Mimetic Value Creation - How to Distribute and Create Mimetic Value - Part 1

In this article, I will summarize my thoughts about memes, distribution, and how they collide. In History of Distribution Methods, I explain that distribution is the most critical component in creating a sustainable, valuable coin. This is also related to my thesis on Crypto Opportunities & Markets.

This article is intended for both founders - how to create a valuable token - and investors - how to spot profitable trends.

Two Essential Steps in Creating a Coin with Value:

Innovation in Distribution. Distribution should create network effects, boost organic adoption, incentivize productive development, and fortify long-term relationships with synergetic teams. This topic is inherently project-specific, but the general goal is to get the coin to essential people who will appreciate its value.

Alignment Between Product and Story. A memorable, and contagious draw into what the asset entails is important for the future of the space. The product also needs to have the ability to accrue value, and the problem that it solves needs to be essential for the future and sit on a big problem set - Celestia is the counter approach for Solana, EigenLayer make ETH more reusable. The solution for industry related problems like scalability and extension of capabilities always get more premium then stuff solving problems for normies.

It is important to understand that the distribution mechanism is the message. There are no ads in web3. Remember, Web2 is for information, Web3 is for money.

That's why the message that a project wants to tell needs to be in the distribution, the mechanism is the message.

Step One: Innovation in Distribution

Past mechanisms for Distribution Include (more on that here)

This is the second aspect of distribution. It’s not only about how you do it but also targeted to whom. This question of who is just as, if not more important, than the how. What is important to say here is that the group that gets it needs to appreciate it and feel it unites them with a bigger cause.

Here are some examples of how different projects did it and how it influenced the result:

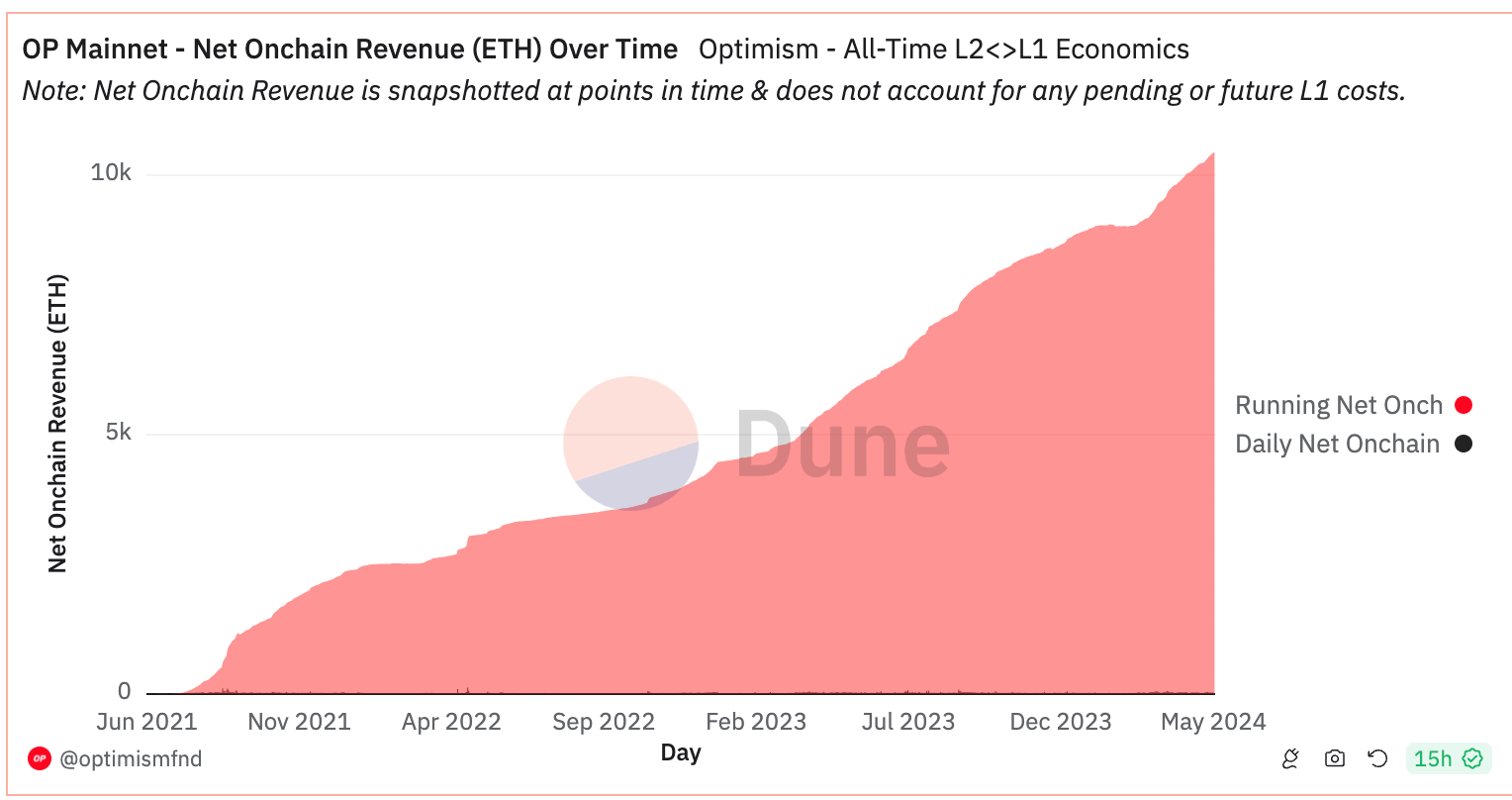

Optimism and Retroactive Grant Funding

Optimism’s market cap is $13 billion. They still operate on a signal node l2, so why are they worth $13 billion? They generously coordinated all the heroes of the space in their Optimism Collective and paid them handsomely.

Optimism's Retroactive Public Goods Funding (RetroPGF) is a grant program that rewards projects and contributors retroactively based on their demonstrated impact and value added to the Optimism ecosystem. This approach contributes to network effects, as can be seen in the increasing numbers of monthly active users in the last six months, Optimism’s distribution strategy has been successful for several reasons:

Incentivizes Innovation. Developers build valuable public goods and tools that benefit the entire Optimism ecosystem - not just a subset - which fosters real growth and adoption. By rewarding projects in a meritocratic way and retroactively rewarding previously successful projects, this system encourages continuous development toward actual use cases. The most notable improvements are infrastructure, tooling, and user experience, all core tenets of a scalable Web3 ecosystem.

2. RetroPGFR creates a self-sustaining economic flywheel. As more projects and contributors are incentivized to build on Optimism, it drives further usage, adoption, and revenue for the network. This surplus revenue can then be reinvested into future RetroPGF rounds, perpetuating the growth cycle.

The graphs above are a quantitative validation for consistency. Revenue growth and user stickiness, which often diminish in projects with aggresive acquisition strategies (see 2023 points-based systems), have sustained over time for Optimism because of this flywheel effect.

3. Aligns incentives between contributors and the long-term success of Optimism. Projects are rewarded based on their actual impact, not speculative promises, ensuring that efforts are directed toward tangible improvements that benefit the network and its users. As noted in the above graphs, Optimism has sustained growing revenues and user retention months after its distribution system hit the markets. Other projects that are attempting to construct robust and sustainable ecosystems should strive for alignment between all stakeholders, but most notable developers and users for Web3 projects.

4. Community engagement and governance development. The evaluation and voting process for RetroPGF grants involves active participation from badge holders and standard community members, promoting decentralized decision-making and accountability. As discussed in my previous writing, creating an engaged community is critical for Web3. So, while it may be a second-order effect, voting incentivizes active participation in the network, communication between members, and positive ownership psychology (see Read Write Own: Building the Next Era of the Internet)

Optimism Recap: By rewarding impactful contributions retroactively, Optimism's RetroPGF program

Incentivizes the Creation of Valuable Public Goods

Aligns Incentives with the Network's Success

Promotes a Diverse Ecosystem

Fosters Community Engagement

Together, these contribute to positive network effects and make it a beneficial distribution strategy for the Optimism ecosystem.

Bittensor ($TAO) and Competitive Subnets

Bittensor is also worth $13 billion. At its core, it’s an innovative funding mechanism—it funds open-source AI projects called subnets and lets them compete over who gets funding. Another aspect is to have another layer of contributors, such as DCG and Polychain.

Internal Competition between Subnets: Subnets are specialized networks that focus on specific AI-related tasks. Each subnet has its own miners and validators responsible for completing tasks and validating outputs. The subnets are designed to be highly competitive, with the top-performing subnets receiving more TAO emissions and rewards. Similar to Optimism, Bittensor has created a meritocratic rewards system based on utility and adoption, not speculation.

Equitable Rewards: TAO is distributed proportionally to staked token holders. This emission is used to fund the subnets, with the top-performing subnets receiving more TAO emissions. It is calculated based on the amount staked by validators and the subnet's score.

Innovative Funding Mechanism: The subnet mechanism attracts and rewards high-quality AI projects, again not specialation. Developers are incentivized to produce high-quality outputs, which are then ranked by validators. The top-ranked outputs are rewarded with TAO emissions, creating a positive feedback loop that encourages competition and innovation.

Validator and Miner Roles: Validators confirm the validity and accuracy of miners’ outputs. Miners submit pre-trained models to the network in exchange for rewards, and then validators select the most accurate outputs and return them to users. This process ensures that high-quality models are incentivized and rewarded, and critically in the utility token TAO.

Supply Constraints and Modulating Demand: Like Uber’s price surges during rush hour, Bittensor dynamically adjusts subnet pricing to match AI service demand. Modulating prices to meet willingness to pay helps BitTensor manage its limited capacity (32 subnet slots) and prioritize high-paying customers.

Procedurally, Bittensor only has 32 registration slots open. This limited availability creates a scarcity effect, making each slot highly valuable and sought after by participants wishing to contribute to the network's infrastructure. It is also important to note that the registration cost is doubled each time a subnet is registered, and if no one registers, the price halves linearly over four days.

The outcome of constrained supply and massive demand is staggering. In February 2024, the cost to register a subnet was $53,000. Only a month later, the registration costs reached $6.7 million (in TAO). This high cost is driven by intense competition among subnets, the limited number of available slots, and the market demand surge.

The statements and graph above relates back to my original proposition token value accrual.

Prominent Investor Support: DCG (Digital Currency Group) and Polychain are critical investors and validators in the Bittensor ecosystem. They contribute to the network by providing resources, technical expertise, and integration opportunities with adjacent AI and infrastructure portfolio companies. Although often overlooked, the non-financial aspects of investment firms - especially in cases of radical and long-term - are critical for market adoption and sustainable strategy.

Bittensor Recap: An incentivized AI model marketplace that leverages competition to foster innovation. The project’s distribution structure includes:

Competitive Emission and Subnet Mechanisms

Innovative and Meritocratic Funding

Superb Investor Support

In turn, it has positioned itself as a market pioneer while developing the foresight for practical use cases and developer-user alignment.

Meme Coin r/Evolution

Why we are on the verge of an explosion of millions of meme coins - the internet’s next frontier.

Why we are on the verge of an explosion of millions of meme coins - the internet’s next frontier.

TL;DR: The question investors ask when deciding if something is valuable just changed.

Instead of asking what product is behind it, they now ask - what community they support and what topic they are pushing towards.

First, what is a Meme Coin?

A meme coin is a coin that relies solely on a community or an idea around which the community revolves.

First-generation meme coins are derivatives of Dogecoin. The community that Dogecoin came from relies on Doge lovers, who usually live in subreddits.

The second generation of meme coins will just be forked products that did well in their airdrops and gave exposure to something people want by rewarding the right communities.

What people considered valuable so far: In crypto, for a long period, meme coins were considered a joke, and the main question people used to ask when evaluating a token was what app or business was behind it.

They used websites like Token Terminal or DeFiLlama to measure a protocol's revenues or fees.

The Next Generation of Meme Coins and Airdrops:

In the last 3 months, 3 product launches helped me realize the change that took place:

The question investors ask when deciding if something is valuable will change. Instead of asking what product is behind it, they will ask - what community they support and what they are about.

The next frontier of meme coins is all about how you airdrop and the exposure to a topic that people can't get enough of.

For it to work, you need to:

Create a community: Giving to communities that relate to the topic you are promoting.

Give them something they want: Original Reward actions. Reward new actions that were not rewarded before.

Ensure your product works and fix problems for this community.

3 Conditions for a Meme Coin to Flourish:

Becoming an Optimal Ceta on the Right Category - within that, there are a couple of things you need to get right :

Choosing the category which is not competitive yet and is going to be competitive soon

Understand the nature of these categories, what ppl are about, what are their goals

Decide things that distinguish your product and your culture and values that make you align with this community.

2. Smart distribution smart distribution means :

Fair game - show people that you cannot rug them

Give tokens to many people that are relevant to the message you are trying to deliver

3. legitimacy - to get people to care, you need to bring people with legitimacy; to be them, you need your thing to help them. Innovating on the problem of the space you are tackling is a great way to do so.

Three products showed me that things changed:

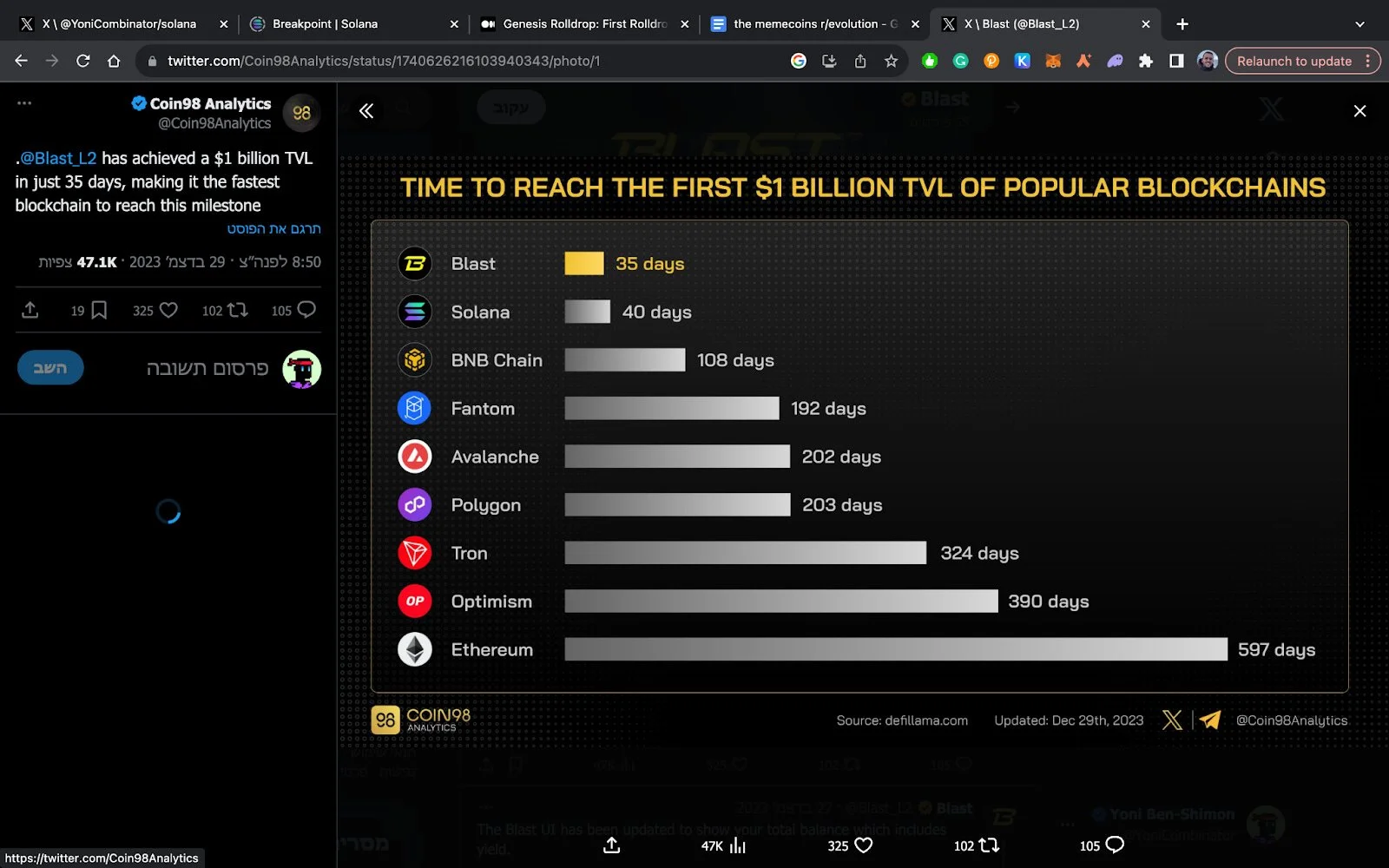

Blast is a rollup that understood one thing: people use a rollup to airdrop farm it. They admitted they would do so and farmed with the money locked in the bridge, sharing the reward with the users.

2. LFG - forked rollup that did one thing - it paid tokens to ETH users to come and take it to Solana. This is an AMAZING use case for the next frontier of meme coins. It was very clear about its ideology - Solana - and its only action is to bring new users to Solana.

3. Dymension - multichain rollup SDK that recently launched a genius airdrop campaign. Because they support multichain, they gave tokens to users across multiple chains. The airdrop turned them into a meme coin, a meme coin that supports the meme of data availability and multichain, things that people are dying to get some exposure to. In addition, they gave tokens to users of Solana products. This is an example of a meme coin; they supported cross-chain and became a way for people to get cheap exposure.

The result? 4.6 million engagements!

The Next Frontier of Meme Coins:

I predict we are going to see hundreds of new kinds of meme coins: tokens that launch original airdrops and innovate on:

Which communities the tokens are being airdropped to.

What actions are they measuring for the airdrop

The category they are standing for.

Programmable Cryptography Use Cases

Exploring the current and future cryptographic landscape

Exploring the current and future cryptographic landscape

The Meaning of Proofs :

We are at the beginning of a new era in cryptography, the ability to create programmable cryptography and to prove so many new things. I'm excited about it because it's really going to enable a world of IoT and a world of decentralized AI. enabling people to make money from their personal data, remote devices to collaborate on data creation , remote computers to power open-source AI models, and many other apps.

First-generation cryptography: encryption, security, and privacy: apps like communication protocols, encryption in messaging apps.

Programmable cryptography :

Proofs for any function

Verification of any claim

Cryptography compilers

Proofs of Computation and Data Use Cases

*Bolded = Programmable Cryptography

Indistinguise obfuscation - what unites it all:

All this enables you to encrypt a program.

zk snarks - Turn math problems into programmable tasks. One of the use cases is membership proofs and programmable membership - I own this and did that and that. I have this data when run through this model gives that output .only allows proof about a private statement that a single person knows.

Collaborative zk snarks - mpc2.0- Multiplayer private state - Perform joined computation over secret distributed over multiple people—a game where my secret item is relevant to your secret item.

FHE - allows to perform computation on an encrypted data

Witness encryption statements with programs ( sudoku puzzle ) and not with keys - only someone who can solve this puzzle has the key to open this.

Programmable Cryptography Use Cases

Request for Data on the Internet - bank(social score), social network(identity - the ability to access data in a p2p way - protocols for that are: zk snarks, private information retrieval - some use cases of that in crypto are zk bridges - proofs of balance on one to another blockchain, zk login ( proofs of google login in a blockchain )

Future Use Cases: decentralized inference for ai, decentralized data sharing protocols, a way to prove a computation on a depin machine or robot, faster provers of identity.

evolution in Infrastructure

evolution in Apps

The Evolution of Programmable Cryptography:

Building the library for your app - zk cash

Circuit languages - like circom - a layer for developers to write circuits

Program to circuit compiler - ezkl python notebook - enabling to write in python and a tool chain to convert it to cryptography

Zkvm, recursion, composition - cryptography abstract away from the developers.

Current Stage:

We have the tools for programmable cryptography and are just starting to understand their implication.

One of the use cases I'm curious about is how to enable any device to prove a computation that can be used for Depin and AI and bring so much valuable data to the world.

Road to Sustainable AND Profitable Open-Source AI

Most models are Closed-Source. Shifting towards an Open-Sourced ecosystem requires overcoming Data Quality, Business Model, and Funding problems.

Most models are Closed-Source. Shifting towards an Open-Sourced ecosystem requires overcoming Data Quality, Business Model, and Funding problems.

THE PROBLEM:

Open-source AI models don't get the same amounts of compute and capital as closed-source AI models are getting.

Current Open-Source Business Models are Unsustainable

Most models are closed-source.

The Funding Problem with Open-Source AI:

Open-source AI needs to find ways to monetize so developers can work on fine-tuning models and releasing them to the world.

Some Approaches for Making Open Models Sustainable:

Building evaluation methods for datasets - Datasets are today's most crucial resource in new models. As more models come online, this presents an opportunity for millions of developers worldwide to create specialized models and build businesses around them. Developers today find it challenging because it is hard to demonstrate the quality of the datasets they make. Building evaluation standards and benchmarks for open models is critical to a Cambrian explosion of open-source models.

Potential business models include:

1. Keeping the datasets closed-source and licensing them while the model remains open.

2. Tokenizing the model.

Tokenizing the ownership of the model to the people who use it - We believe this is the holy grail of open-source AI. Tokenize models.

Tokenized Models:

What we envision is a model that developers use to build apps. They pay the model for API calls and, while paying, earn an ownership stake in it.

What Is the Business Model of a Model? We imagine a business model similar to a Layer 1 (L1) blockchain, where the model is used to build decentralized applications (DApps) and charges 'gas'. Applications created this way generate revenue, some of which return to the model.

What the Token Will Do:

The token will represent ownership and be distributed to users based on usage. The more you pay, the more ownership you acquire. This ownership entitles you to a share of the revenues from the built apps.

The Potential of the Combination of Evaluation for Datasets and Tokenization for Models:

With this combination, it will be MUCH easier for anyone fine-tuning an open-source model to secure funding because:

The model will generate money predictably and straightforwardly - users are owners, and the compute cost will always be covered (by the users).

The assurance of obtaining high-quality datasets will be more significant - so investors will be confident that the model will be of high quality. In addition, the dataset alone will be an asset that the developer can potentially monetize, possibly by licensing it to others.

The World We Imagine:

We envision a world with millions of specialized models and millions of young, millionaire open-source developers who have created something hugely valuable while working from their parent's homes. We want to encourage this world.

Podcast #4: Decentralized & Open-source AI in Crypto

Yoni Ben Shimon Podcast Episode #4

Yoni Ben Shimon Podcast Episode #4

Decentralized AI has the potential to - and will likely - revolutionize Web3.

In this podcast, I evaluate the current Decentralized AI projects and future investment opportunities in this category. More specifically, Ellis and I uncovered the critical problems and ideas that decentralized compute, inference, model training, and much more.

We also answer the following critical questions:

What are the current inadequacies in centralized AI that spawned this new decentralization?

How can investors stay up-to-date and make informed project investment decisions?

How can we leverage current decentralized AI to build a personalized thesis?

What are the leading projects we should all be following?

In the later part of the episode, we thoroughly investigate the current decentralized AI projects, the problems they seek to solve, and how to stay active within their community base. For my own investment strategy, I couple the same category approach with a thorough investigation of the incentive systems, emission schedules, and most importantly, developer/community engagement.

Additional References

Getting Started in Open Source ai :

Decentralized AI in Web3 (current projects)

Automation and Agents

$OLAS

$GELATO

$FETCH

Decentralized Compute :

$NOS

$AKT

https://io.net/

$RNDR

Decentralized Models

TAO

Inference

Ritual

Storage :

$AR

$FIL

Podcast #3: Investing in the Bull Run - Emerging vs. Established Categories

Yoni Ben Shimon Podcast - featuring Ellis Osborn

Yoni Ben Shimon Podcast - featuring Ellis Osborn

In this podcast, I cover my successful investment framework as a ten-year crypto veteran:

Focus on category, team, clout, token, and product

Finding category leaders in bear vs. bull markets

Divesting: when and why

Following the previous article, "Imbalanced Memes", I will expand and elaborate on how to invest based on the same idea.

The basic idea is that investors want to get exposure to topics. Some topics have winners, and some still need winners. These discrepancies, which are misalignments between supply and demand, are where lucrative opportunities exist.

The best-performing assets invent categories and become the leaders of these categories.

Some examples are:

ETH of India - $MATIC

Play to earn - $AXIE

Monolithic that scale - $SOLANA

NFT trading - $BLUR

DEX - $UNISWAP

How to Spot Monopolies:

90% of the category value usually goes to the category winner.

Now, there is something tricky here: there are established categories and non-established categories. Let's expand.

Established Categories:

a. L1s- $ETH

b. zk rollups - $STRK / $ZKS

c. optimistic rollups - $OP / $ARB

d. ETH of India - $MATIC

e. Play to earn - $AXIE

f. Monolithic that scale - $SOLANA

g. NFT trading - $BLUR

h. DEX - $UNISWAP

i. LSD - $LDO

j. DAG POW blockchain - $KAS

k. Cross-chain DEX - $RUNE

l. Metaverse V1 - $SAND / Decentraland

m. Decentralized perps - SNX / DYDX

n. Lending protocols: $AAVE

o. Fiat-Backed Stablecoins - $USDT

p. Algorithmic Stablecoins - $FRAX

q. Bribing protocol for stable coins - $CVX

Non-Established Categories - Someone Else Can Become the Leader

a. AI L1 - $TAO

b. DEPIN $HNT

c. RWA - $CFG

d. FHE - Unknown

e. Restaking - EigenLayer

f. Modular blockchain - $TIA

g. Identity - $WLD

h.Separation of yield and principle - $PENDLE

i. Payments - Gnosis Pay

Where to build sub-categories (blue ocean ecosystems/categories)

Subnets in Bittensor - Bittensor may create a new ai l1 and a new ecosystem; hence, building on top could be lucrative.

AVS on EigenLayer - EigenLayer enables a new frontier of dApps that get ETH scale. Creating such dApps is an opportunity.

Sub-categories :

Another thing that is important to understand is that every time there is an ecosystem around a category, there are categories. For example :

DEX in a new chain

Meme coin on a new chain

bribing protocol for a new chain

How to value a category and the associated risk of new categories

Value of a category - Most category leaders get a value of 2B USD in a bull market if the category has product-market fit and 30B USD if the category is the hot topic of the day.

New categories have the highest return but also the highest risk because this category may not be big or not get validated as people think it will, and then you might lose money.

Investing in Beta Assets:

Another topic to talk about is investing in beta assets. A beta asset is an asset that correlates with something else but usually moves more aggressively. Beta assets are valuable to double down on your conviction.

For example, if you are bullish on Solana, investing in Bonk is a good idea because it has a high Beta.

Investing in Second Best Assets:

There is a common mistake of wanting to invest in second-best assets. The second-best assets are copycats and usually get less than 15% of the category market cap. It's only worthwhile investing in the second best if you think the category will become more valuable than 30B USD.

Bittensor: Machine Learning Decentralized

Marketplace for Machine Intelligence

Marketplace for Machine Intelligence

ChatGPT and its subsequent iterations ushered in an incredible year of AI. Every startup sought to pivot to AI

while tech giants like Google scrambled to find their foothold in the space. But amidst these centralized corporations fighting for a share of the pie, one project has been quietly pioneering its own paradigm - decentralized intelligence - which could change how AI is developed and accessed forever.

Enter Bittensor.

What is Bittensor?

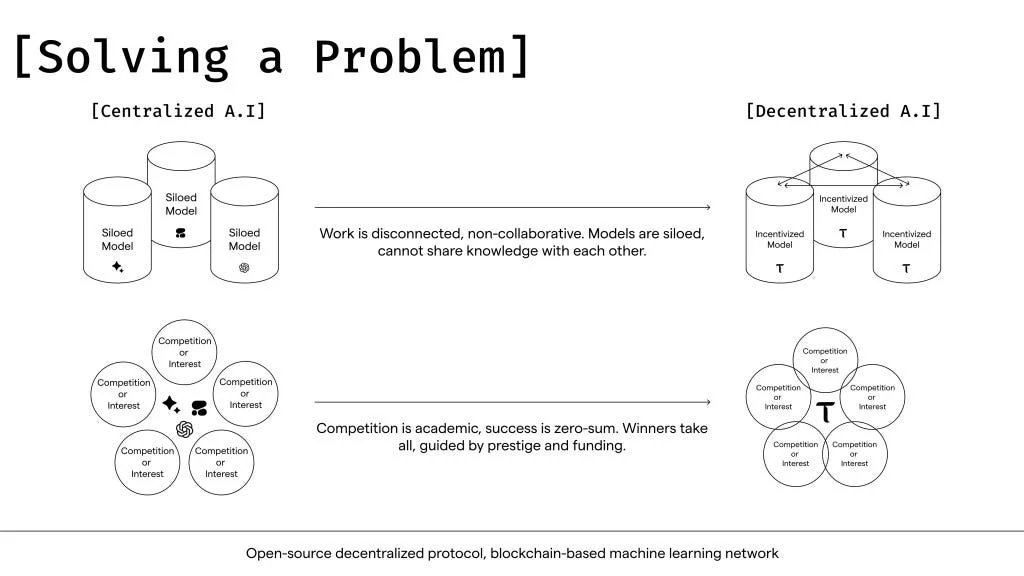

Bittensor seeks to decentralize access to AI and the development of machine learning models, which have long been accessible only to large, centralized corporations such as OpenAI and Google, which had the resources to pour into training these models.

Such training often cost these companies millions in funding, which was well out of reach for most smaller companies, much less individuals. Bittensor is designed as the marketplace for machine intelligence, using a peer-to-peer network to value the intelligence stored on the network as well as reward honest contributors to the network.

Beyond just increasing the accessibility of machine learning capabilities, Bittensor was designed to tear down the walls of siloed systems that corporations built to protect their machine learning models. By opening up the models built through Bittensor, Bittensor would enable composability and compounding of AI development, further pushing the space forward.

The Bittensor Network

To achieve its goals of censorship-resistant access to machine learning models, the Bittensor team originally built the network as a parachain, Finney, on the Polkadot network. This decision was later reversed, and Bittensor later migrated to its own chain to reduce reliance on the Polkadot ecosystem. Bittensor launched its own Proof-of-Work chain in March 2023, which was designed after the original cryptocurrency, Bitcoin.

Bitcoin brought computers together to validate which validators had the most computing power through Proof-of-Work and thus were entitled to the largest rewards. In essence, Bitcoin created an efficient market for computing power. Similarly, Bittensor treats data as a commodity, and the network seeks to create a marketplace for machine intelligence where intelligence is valued and scored in a peer-to-peer manner. These scores are recorded on a digital ledger, where peers are rewarded based on the rank awarded, thereby granting them more weight in the network.

Thwarting Collusion on Bittensor

However, in its simplest form, this system faces the threat of collusion, which could easily undermine the network’s accuracy. By simple collusion, peers in the network could rank each other highly through dishonest voting. Bittensor takes a two-pronged approach to target this threat - through incentives and bonds.

Expanding on the basic ranking model, Bittensor introduces an incentive component to reduce the risk of collusion. The network limits the rewards available to peers who have not reached a consensus. Consensus, in this case, refers to the peer having achieved a non-zero ranking from more than 50% of the stake in the network. This means that assuming the malicious actors do not already hold a majority stake in the network, they would have to gain votes from the honest majority in order to increase the rewards they are earning to gain a greater share of the network.

While the incentive component above protects the network from simple collusion, it does not incentivize honest ranking of peers in the network. Bittensor encourages this via bonds, which can be considered a speculative element in the ranking system. In simple terms, a peer accumulates bonds with peers that they rank, in a sense ‘bonding’ them to these peers. If these peers do well due to their contributions to the network, their bonded peers also benefit from greater rewards. As such, the bonding mechanism encourages peers to accumulate bonds with peers that they expect to be perceived well by other peers in the network, thus speculating on their future value. Therefore, this aligns peer ranking within the network and incentivizes honest ranking of peers.

Subnetworks

The Bittensor network is split into a handful of smaller networks known as subnetworks. Each of these subnetworks can be thought of as a self-contained economic market to incentivize access to different forms of machine intelligence, such as text generation, image generation, data scraping, machine translation, and more. Each subnetwork is set up and run by an owner, who will also determine the incentive structure of the subnetwork. Every subnetwork will consist of 3 types of users: miners, validators, and end users.

Miners, sometimes known as servers, are off-chain machine learning nodes that service requests on the network for data from the network users. The work submitted by these miners is evaluated and valued, after which they are rewarded in Bittensor’s native token, TAO, as a reward for their contribution. Miners who repeatedly submit inferior work will eventually be disincentivized to participate and drop out of the subnetwork.

Validators validate the work done by miners to ensure that the work is accurate and up to the standards of the subnetwork. While subnetworks can provide a validation template for validators to use, validators can also write their own validation mechanisms to express their preferences on what the network should learn. Not only does this encourage miners to continuously improve their output, but it also increases diversity in the network and reduces the risk of any shareholder dictating what the network should be learning.

Finally, end users are the customers of the Bittensor network. They make requests via the Bittensor API, BitAPAI, which is then passed to the miners to be fulfilled. These subnetworks are designed to be easily accessible via common programming languages such as Python, Node.js, Golang, Rust, and more. At the moment, BitAPAI is free to use to encourage the development of the network, although each key is limited for now to prevent abuse.

Projects Built on Bittensor

Although Bittensor is still very much in its infancy, several projects have already sprung up to tap into the value of the network.

A popular type of project building on the network is ChatGPT-style AI systems, where users enter a text input and receive a reply from the system. Some of the projects in this space include Chattensor, ChatNI, Chat with Hal and BitAPAI Chat.

ReplyTensor is another popular Bittensor project, which leverages the text and image generation subnets to generate replies based on users’ prompts. Currently, the service is supported on Twitter, Telegram and Discord. ReplyTensor is developed by Neural Internet; an AI-focused research and development DAO who has also been one of the most active builders on Bittensor.

The TAO Token

The Bittensor network, much like Bitcoin, is powered by a single token, TAO. Designed to promote censorship resistance and fairness, the tokenomics of TAO follows Bitcoin’s design closely as well, with no presale or private token deals. Even the founding team had to mine for their own TAO tokens.

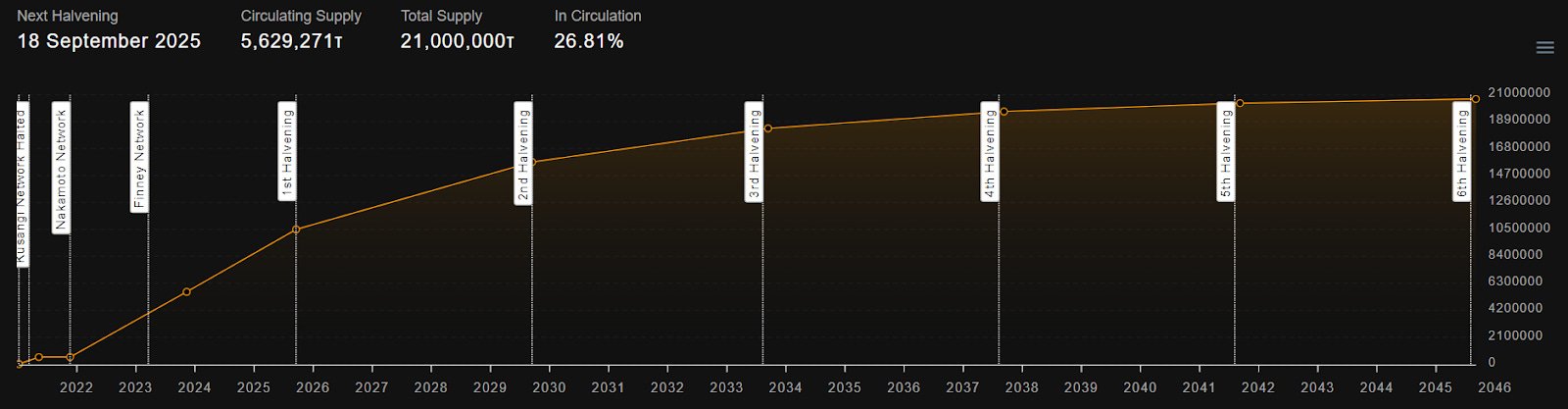

TAO also follows Bitcoin’s supply and release schedule, with a maximum supply of 21 million tokens and a halvening process every 10.5 million blocks, which cuts the TAO inflation rate by half every time. The first halvening event is expected to occur in September 2025, with a total of 64 halving events.

Conclusion

The siloed approach and high cost of training hold back the development of machine learning models and suppress innovation in the space. As AI continues to evolve and increasingly revolutionize the way we work, Bittensor will become an increasingly powerful force in the AI space.

Leveraging its decentralized approach to the training of machine learning models and the composability it provides, Bittensor’s goal is to eventually become the marketplace for machine intelligence, where individuals, smaller companies and even corporations pay in TAO to connect to the Bittensor network and utilize its resources.

Podcast #2: Imbalanced Memes in Crypto

Yoni Ben Shimon Podcast - featuring Ellis Osborn

Yoni Ben Shimon Podcast - featuring Ellis Osborn

Episode #2: Imbalanced Memes in Crypto

How can investors leverage imbalanced memes to find alpha? How can retail traders distinguish between practical information vs. dogma at conferences and online?

We dive deep into the imbalanced memes debate in Episode #2 of the Yoni Ben Shimon Podcast.

Ellis and I first discuss these memes' emergence and detailed history from a first-person perspective (2017-present). The growth of imbalanced memes has forever shaped the crypto social media and conference landscape.

Later in the episode, I contrast individual narratives vs. macro trends when making investment decisions. This thought process is the cornerstone of imbalanced memes, but for obvious reasons, systematic trends are difficult to predict and analyze. So, we have included numerous ways to get exposed to imbalanced memes, namely through following relevant thought leaders in Web3 and staying up to date with specialized research reports.

Podcast #1: Combatting Modern Anti-Semitism

Yoni Ben Shimon Podcast - Episode #1 featuring Ellis Osborn

Yoni Ben Shimon Podcast - Episode #1 featuring Ellis Osborn

Episode #1: Rise of Modern Anti-Semitism: A First-Person Perspective

Understanding the Current State of Anti-Semitism:

Anti-Semitism is a complex and pervasive problem that affects not only Israel but the global Jewish community. During the podcast, I shared my personal insights into the current state of Anti-Semitism and how it has evolved in recent months. We delved into the challenges of balancing free speech and preventing future hate speech, as well as the impact of social welfare fake news. It's essential to recognize that the reality on the ground often differs from what we see in the media, and this disconnect can make it challenging to address the issue effectively.

Personal Experiences and Anecdotes:

I shared some personal experiences and anecdotes that shed light on the impact of Anti-Semitism on daily life in Israel. It's not just about the present war; this issue has deeper roots and has affected us for years. These stories emphasize the need for continued efforts to combat Anti-Semitism.

The Role of Government and Society:

We also discussed how Israel often finds itself at the center of global discussions on Anti-Semitism. I believe that the Israeli government and society are actively addressing this issue, both domestically and internationally. However, there are still numerous challenges that we must face head-on.

Challenges and Hope for the Future:

One of the essential parts of the conversation was about the main challenges facing Jewish communities in Israel and around the world in combating Anti-Semitism. Identifying these challenges is crucial to finding effective solutions.

Web3 and Cryptocurrency:

In the context of Web3 and cryptocurrency, we explored specific examples of individuals, organizations, and projects that are actively working to counter Anti-Semitism. The intersection of cryptocurrency and Anti-Semitism is evolving, and we discussed the proactive steps that the community can take to mitigate harm.

Social Media and Online Anti-Semitism:

I also touched on the role of social media and the internet in spreading hate speech and Anti-Semitic sentiments. It's crucial for individuals, organizations, and governments to collaborate effectively in combating online Anti-Semitism.

Raising Awareness and Fostering Cooperation:

Lastly, we talked about what individuals, regardless of their religious or cultural backgrounds, can do to raise awareness and combat Anti-Semitism in their communities. In a world where tensions are high, fostering better understanding and cooperation among different communities is vital.

Looking to the Future:

I closed the podcast episode with my hopes and expectations for the trajectory of Anti-Semitism and the efforts to combat it, both in Israel and globally. There's much work to be done, but with continued dialogue and collaboration, I believe we can make progress.

I hope this post provides a more in-depth perspective on the topics we discussed during the podcast. I look forward to your thoughts and feedback on this crucial issue.

21.8- next crypto trends -

storage revenues, community , rollups and daos

storage revenues, community , rollups and daos

The trends that i want to explore are :

New versions of amms (1,2,3)

Ideas :

Private pools - Use case for premissioned pools

Fee model that fit the use case - different fees needed based on the asset volatility

Not 24/7 liquidity pools -pool LPs could decide via governance to turn off the pool when they believe it no longer makes sense to keep quoting.

Different pricing curves - different parameters then the amount of assets in the pool (pure pricing functions). One example is a price function that takes 50 bips fee on top of the Coinbase price.

Or signature based pricing - a desk gives a quote based on the on chain liquidity -- takes the price from centralized exchanges order books and reflect it on chain

Implementations

1inch- aggregate orders to market makers

Ideas :

zarollups exchanges- set of transactions can be bundled together into a single transaction via zk-snark cryptography.

Optimistic Rollup- Fraud proofs are the mechanism to prove that the state transitions performed by the aggregator (entity responsible for off-chain transactions rollup) were fraudulent and results in a roll-back of the rollup side-chain.

Implementations :

The Loopring Protocol v3.0

Synthetix OVM Exchange Demo

Optimism

Fuel Labs -- have developed a highly optimised UTXO based optimistic rollup for fast, secure and cost-efficient ERC20 swaps

Ideas -

Token curated communities - premissiond groups

Implementations-

Tokenized communities :

Karma dao

Defiomega / $dfio- 100 $DFIO, or 10k for a board memberships, 1k members cap

$JAMM- Brian Flynn’s Jamm Session newsletter community, Flynn has accordingly committed to adding a new element to $JAMM once a week to extend the TCC project to new horizons.

$DDIM, or the Duck DAO Dime,

2. Platforms :

Daofi - decentralized exchange built for community use cases

DAOhaus V2 — an upgraded, community-operated, sustainability-focused product to spawn magic internet communities. weekly workshops called War Camps, people share their progress and receive feedback from other divisions in the project. Native token -HAUS

For core contributors, the goal is to make DAOhaus sustainable through DAO-upgrades called Boosts.

4. Interesting daos

5. Storage --other source of revenue for defi -

Ideas :to capture the fees people pay for storage through platforms like arweave,sia and filecoin.

Cash flow coins - the way it work with yearn is that each vault is a way for users to participate in revenues such as curve lp or comp lending. Earn is automatic and vaults is strategies . the contract takes fees for withdrawals and for performance fees.