Distribution and Mimetic Value Creation

Mimetic Value Creation - How to Distribute and Create Mimetic Value - Part 1

In this article, I will summarize my thoughts about memes, distribution, and how they collide. In History of Distribution Methods, I explain that distribution is the most critical component in creating a sustainable, valuable coin. This is also related to my thesis on Crypto Opportunities & Markets.

This article is intended for both founders - how to create a valuable token - and investors - how to spot profitable trends.

Two Essential Steps in Creating a Coin with Value:

Innovation in Distribution. Distribution should create network effects, boost organic adoption, incentivize productive development, and fortify long-term relationships with synergetic teams. This topic is inherently project-specific, but the general goal is to get the coin to essential people who will appreciate its value.

Alignment Between Product and Story. A memorable, and contagious draw into what the asset entails is important for the future of the space. The product also needs to have the ability to accrue value, and the problem that it solves needs to be essential for the future and sit on a big problem set - Celestia is the counter approach for Solana, EigenLayer make ETH more reusable. The solution for industry related problems like scalability and extension of capabilities always get more premium then stuff solving problems for normies.

It is important to understand that the distribution mechanism is the message. There are no ads in web3. Remember, Web2 is for information, Web3 is for money.

That's why the message that a project wants to tell needs to be in the distribution, the mechanism is the message.

Step One: Innovation in Distribution

Past mechanisms for Distribution Include (more on that here)

This is the second aspect of distribution. It’s not only about how you do it but also targeted to whom. This question of who is just as, if not more important, than the how. What is important to say here is that the group that gets it needs to appreciate it and feel it unites them with a bigger cause.

Here are some examples of how different projects did it and how it influenced the result:

Optimism and Retroactive Grant Funding

Optimism’s market cap is $13 billion. They still operate on a signal node l2, so why are they worth $13 billion? They generously coordinated all the heroes of the space in their Optimism Collective and paid them handsomely.

Optimism's Retroactive Public Goods Funding (RetroPGF) is a grant program that rewards projects and contributors retroactively based on their demonstrated impact and value added to the Optimism ecosystem. This approach contributes to network effects, as can be seen in the increasing numbers of monthly active users in the last six months, Optimism’s distribution strategy has been successful for several reasons:

Incentivizes Innovation. Developers build valuable public goods and tools that benefit the entire Optimism ecosystem - not just a subset - which fosters real growth and adoption. By rewarding projects in a meritocratic way and retroactively rewarding previously successful projects, this system encourages continuous development toward actual use cases. The most notable improvements are infrastructure, tooling, and user experience, all core tenets of a scalable Web3 ecosystem.

2. RetroPGFR creates a self-sustaining economic flywheel. As more projects and contributors are incentivized to build on Optimism, it drives further usage, adoption, and revenue for the network. This surplus revenue can then be reinvested into future RetroPGF rounds, perpetuating the growth cycle.

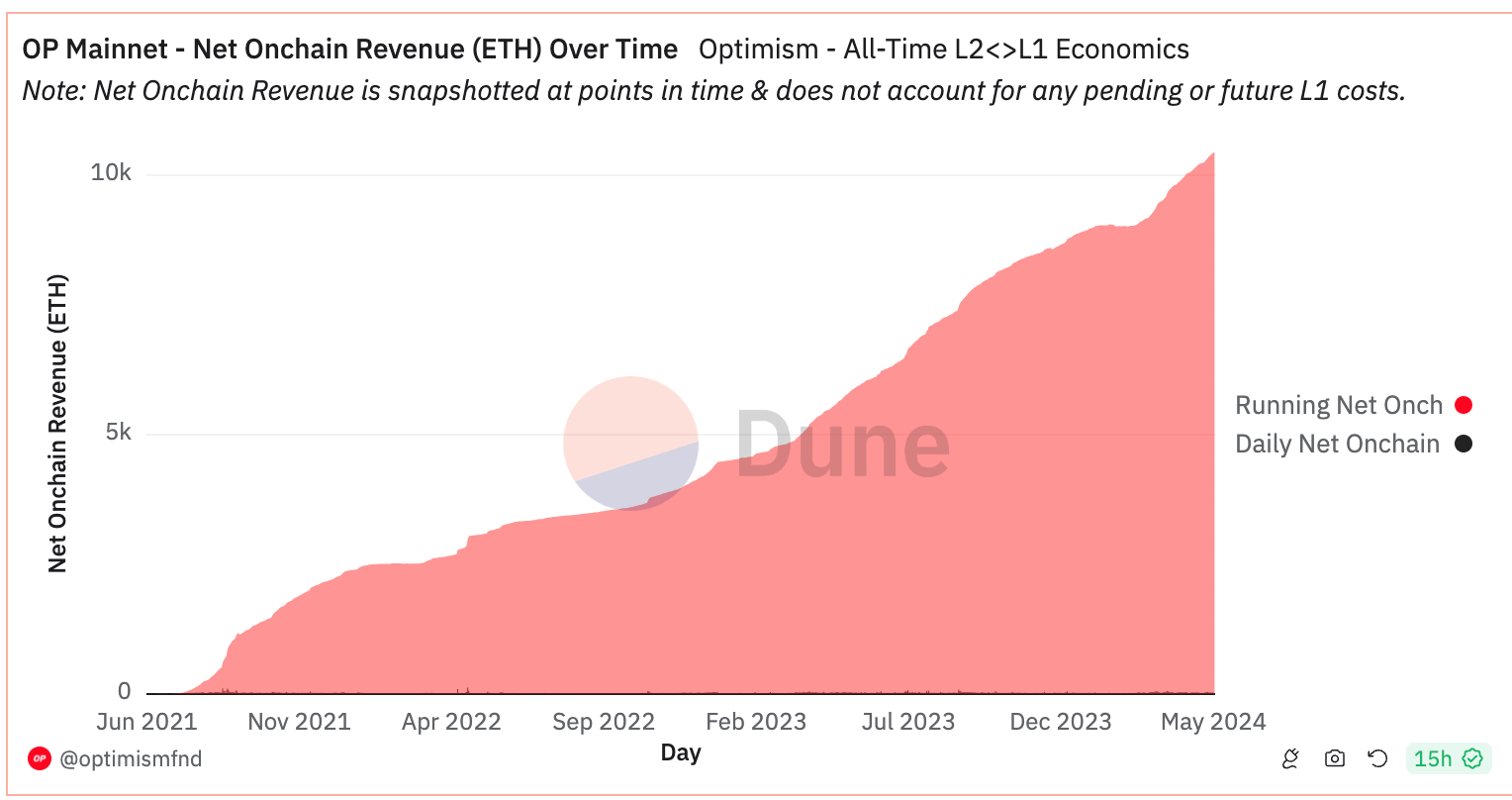

The graphs above are a quantitative validation for consistency. Revenue growth and user stickiness, which often diminish in projects with aggresive acquisition strategies (see 2023 points-based systems), have sustained over time for Optimism because of this flywheel effect.

3. Aligns incentives between contributors and the long-term success of Optimism. Projects are rewarded based on their actual impact, not speculative promises, ensuring that efforts are directed toward tangible improvements that benefit the network and its users. As noted in the above graphs, Optimism has sustained growing revenues and user retention months after its distribution system hit the markets. Other projects that are attempting to construct robust and sustainable ecosystems should strive for alignment between all stakeholders, but most notable developers and users for Web3 projects.

4. Community engagement and governance development. The evaluation and voting process for RetroPGF grants involves active participation from badge holders and standard community members, promoting decentralized decision-making and accountability. As discussed in my previous writing, creating an engaged community is critical for Web3. So, while it may be a second-order effect, voting incentivizes active participation in the network, communication between members, and positive ownership psychology (see Read Write Own: Building the Next Era of the Internet)

Optimism Recap: By rewarding impactful contributions retroactively, Optimism's RetroPGF program

Incentivizes the Creation of Valuable Public Goods

Aligns Incentives with the Network's Success

Promotes a Diverse Ecosystem

Fosters Community Engagement

Together, these contribute to positive network effects and make it a beneficial distribution strategy for the Optimism ecosystem.

Bittensor ($TAO) and Competitive Subnets

Bittensor is also worth $13 billion. At its core, it’s an innovative funding mechanism—it funds open-source AI projects called subnets and lets them compete over who gets funding. Another aspect is to have another layer of contributors, such as DCG and Polychain.

Internal Competition between Subnets: Subnets are specialized networks that focus on specific AI-related tasks. Each subnet has its own miners and validators responsible for completing tasks and validating outputs. The subnets are designed to be highly competitive, with the top-performing subnets receiving more TAO emissions and rewards. Similar to Optimism, Bittensor has created a meritocratic rewards system based on utility and adoption, not speculation.

Equitable Rewards: TAO is distributed proportionally to staked token holders. This emission is used to fund the subnets, with the top-performing subnets receiving more TAO emissions. It is calculated based on the amount staked by validators and the subnet's score.

Innovative Funding Mechanism: The subnet mechanism attracts and rewards high-quality AI projects, again not specialation. Developers are incentivized to produce high-quality outputs, which are then ranked by validators. The top-ranked outputs are rewarded with TAO emissions, creating a positive feedback loop that encourages competition and innovation.

Validator and Miner Roles: Validators confirm the validity and accuracy of miners’ outputs. Miners submit pre-trained models to the network in exchange for rewards, and then validators select the most accurate outputs and return them to users. This process ensures that high-quality models are incentivized and rewarded, and critically in the utility token TAO.

Supply Constraints and Modulating Demand: Like Uber’s price surges during rush hour, Bittensor dynamically adjusts subnet pricing to match AI service demand. Modulating prices to meet willingness to pay helps BitTensor manage its limited capacity (32 subnet slots) and prioritize high-paying customers.

Procedurally, Bittensor only has 32 registration slots open. This limited availability creates a scarcity effect, making each slot highly valuable and sought after by participants wishing to contribute to the network's infrastructure. It is also important to note that the registration cost is doubled each time a subnet is registered, and if no one registers, the price halves linearly over four days.

The outcome of constrained supply and massive demand is staggering. In February 2024, the cost to register a subnet was $53,000. Only a month later, the registration costs reached $6.7 million (in TAO). This high cost is driven by intense competition among subnets, the limited number of available slots, and the market demand surge.

The statements and graph above relates back to my original proposition token value accrual.

Prominent Investor Support: DCG (Digital Currency Group) and Polychain are critical investors and validators in the Bittensor ecosystem. They contribute to the network by providing resources, technical expertise, and integration opportunities with adjacent AI and infrastructure portfolio companies. Although often overlooked, the non-financial aspects of investment firms - especially in cases of radical and long-term - are critical for market adoption and sustainable strategy.

Bittensor Recap: An incentivized AI model marketplace that leverages competition to foster innovation. The project’s distribution structure includes:

Competitive Emission and Subnet Mechanisms

Innovative and Meritocratic Funding

Superb Investor Support

In turn, it has positioned itself as a market pioneer while developing the foresight for practical use cases and developer-user alignment.